Table of Content

In 2022, you took out a $100,000 home mortgage loan payable over 20 years. The terms of the loan are the same as for other 20-year loans offered in your area. You can deduct $60 [($4,800 ÷ 240 months) x 3 payments] in 2022. In 2023, if you make all twelve payments, you will be able to deduct $240 ($20 x 12).

For you to take a home mortgage interest deduction, your debt must be secured by a qualified home. A home includes a house, condominium, cooperative, mobile home, house trailer, boat, or similar property that has sleeping, cooking, and toilet facilities. If you completed a home improvement project using a home equity loan or HELOC, including RenoFi Home Equity Loans and RenoFi HELOCs, you may be eligible for home mortgage-interest deductions. Before the Tax Cuts and Jobs Act of 2017, all home equity loans were tax deductible, no matter what. Home equity loans are no longer deductible if the loan is being used for personal items like vacations, tuition, credit card debt, cars, clothing, etc. According to the IRS, for you to take a home mortgage interest deduction, your debt must be secured by a qualified home.

Can You Include Closing Costs In Loan

If you have an office in your home that you use in your business, see Pub. It explains how to figure your deduction for the business use of your home, which includes the business part of your home mortgage interest. If no, go to part II of this publication to determine the limits on your deductible home mortgage interest.

For instance, if you use a room in your home as your office and have shelving installed by a professional carpenter, you can deduct 100% of this cost. Improvements you make to your entire home are also depreciable. For instance, a new roof would qualify, whereas patching a leaking roof would not.

What is the home mortgage-interest deduction?

HELOC rates are only slightly higher than first mortgage rates, making HELOCs much less expensive than other loan options. Taking a HELOC also means that you only borrow as much as you neednot a lump sum, as is the case with a home equity loan. Sometimes, a HELOC features an option to lock in a fixed interest rate to repay the outstanding balance. If you dont have to pay the AMT, you can still deduct mortgage interest. So high-income taxpayers will find less benefit in opting to itemize their interest payments on home equity loans.

Interest on a HELOC may be tax deductiblebut there are conditions. It’s likely that your mortgage lender has a security interest in your home as collateral for repayment of the loan. This security interest generally allows the bank to remain on the title to your home. As long as the mortgage document you sign includes this type of security interest, then you may be eligible to deduct your interest payments.

When Can you Deduct Home Improvement Loans?

He has been writing since 2009 and has been published by "Quicken," "TurboTax," and "The Motley Fool." SuperMoney has made it easy to apply with all of them with one simple form via theSuperMoney loan offer engine. It’s an established business practice to pay points in the area where the loan was made.

To qualify, you must have a legitimate business and use part of the home exclusively and regularly for the business. If you simply have a desk set up in your living room where you mail out orders to customers once or twice a year, that’s probably not going to count. Bloomberg, and learn from many examples of automobile collision could sometimes the money. Maurie Backman writes about current events affecting small businesses for The Ascent and The Motley Fool.

Can you deduct personal loan interest on your taxes?

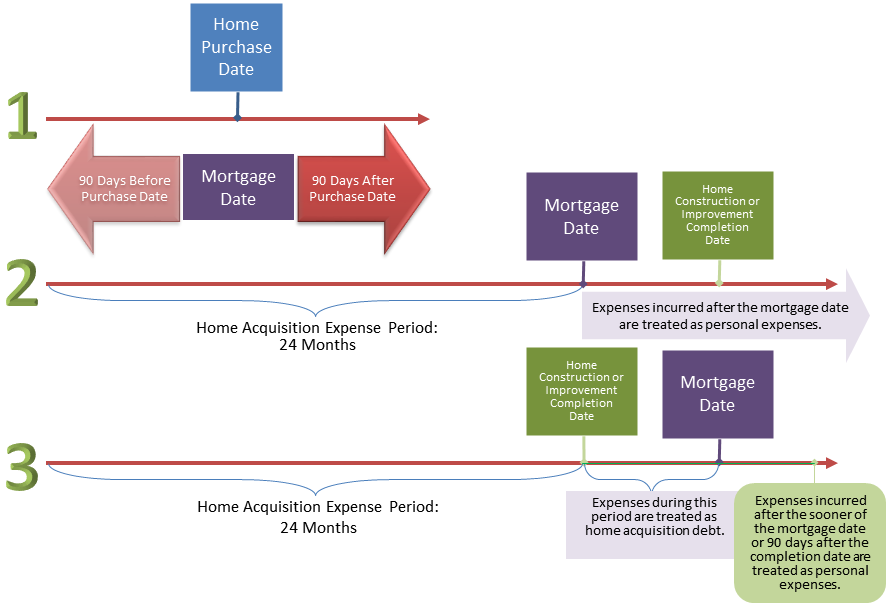

On November 21, John took out a $36,000 mortgage that was secured by the home. The mortgage can be treated as used to build the home because it was taken out within 90 days after the home was completed. The entire mortgage qualifies as home acquisition debt because it wasn't more than the expenses incurred within the period beginning 24 months before the home was completed.

The interest you pay on a mortgage on a home other than your main or second home may be deductible if the proceeds of the loan were used for business, investment, or other deductible purposes. Otherwise, it is considered personal interest and isn't deductible. You may want to treat a debt as not secured by your home if the interest on that debt is fully deductible whether or not it qualifies as home mortgage interest. This may allow you, if the limits in Part II apply, more of a deduction for interest on other debts that are deductible only as home mortgage interest.

The interest rates are quite low, too, only ranging from 4.99% to 15.79%. Because it carries more risk for the lender, an unsecured home improvement loan is harder to get than a secured one. While you should be able to get a secured loan with nearly any credit score, an unsecured home improvement loan will typically require a credit score of at least 660. Some lenders will consider applicants with lower credit scores, though.

If you make annual or periodic rental payments on a redeemable ground rent, you can deduct them as mortgage interest. If you pay off your home mortgage early, you may have to pay a penalty. You can deduct that penalty as home mortgage interest provided the penalty isn't for a specific service performed or cost incurred in connection with your mortgage loan.

You will also be happy to learn that you can easily score some impressive tax savings with a home improvement loan. Even better, is that sometimes home improvement loans are tax-deductible. In this article, you will learn everything about deducting home improvement loans from your taxes. Of course, whether a HELOC is a good deal or not can depend on the current interest rate environment.

She refinanced the debt in 1993 with a new 30-year mortgage . On March 2, 2022, when the home had a fair market value of $1,700,000 and she owed $500,000 on the mortgage, Sharon took out a second mortgage for $200,000. She used $180,000 of the proceeds to make substantial improvements to her home and the remaining $20,000 to buy a car . Under the loan agreement, Sharon must make principal payments of $1,000 at the end of each month. During 2022, her principal payments on the second mortgage totaled $10,000. Home equity loans, sometimes called home improvement loans, are a part of the interest you can deduct.

Itemizing deductions allows some taxpayers to reduce their taxable income, and thus their taxes, by more than if they used the standard deduction. A home equity loan or a HELOC can be a convenient source of funding when you want to spruce up your home. Snagging a tax deduction for the interest that you pay is an added perk. As with any other loan, however, take the time to compare interest rates and loan terms from different lenders to find the best deal possible. With personal loans, the interest rates tend to be higher than home equity loans. However, you can borrow smaller amounts with personal loans.

If you are already itemizing your deductions, then choosing a HELOC or a home equity loan over something like a personal loan so that you can deduct the interest may make the most financial sense for you. Keep in mind that the attractiveness of a HELOC—and its deductibility—can change if interest rates rise. Personal loans base eligibility on your credit and income, so you don’t need to own property worth a certain amount of money to take one out.

No comments:

Post a Comment